Why ProtectVEST?

CONSIDER THE METAPHOR FURTHER...

To spend something like 'Eleven Quarters 'polishing up your clients shoes' to 'a high premium-level shine' after the '2009 market lows' only to allow their shoes 'to deteriorate' once again 'on the street,' especially on 'a trek' through yet another 'Presidential Election Year Storm and Cycle' and all the 'storm puddles' typically found then, is demoralizing for both you and your clients, and can be devastating to their planned financial goals and their trust. 60% was shaved from the large cap stick composite indexes from their highs two years earlier.

You can help protect and secure that 'valuable buff and shine' you achieved on your 'clients' portfolio values,' and also protect the effects of that invested WORK-TIME you both also so ardently and diligently 'worked up' to acquire that 'high premium-level Stock Portfolio Value shine" again!

(And your clients will love you doing for this! 'Whipsawing' around is no fun at all!)

Using the metaphor to further illustrate, you can learn to design 'just the right boots,' and just the 'right cover' for you, for each of your clients, and/or for all of your clients in aggregate as well, to help protect your portfolio net values against the detoriorating price effects of these 'rainy days and these storm puddles,' as you might choose!

Learning about the ProtectVEST and AdvanceVEST by EchoVectorVEST Motion Dynamics and Precision Pivots Forecast Model and ALERT Paradigm And Active Advanced Position Management Technology can help.

Its forecasted 'market weather,' including its detection of these 'incoming rain clouds,' so you and your clients might not be caught off guard and get 'portfolio value wet,' when these adversities are on their way, and may otherwise be difficult for you to see, is a valuable learning aid.

(The ProtectVEST Methodology can even provide timely ALERTs to approaching 'rainy mornings, rainy afternoons, rainy days, and rainy weeks, coming in what are the otherwise clear and sunny seasons as well!)

And you can 'put on' your 'tailored boot covers', applying them at moments, and at times, that you elect!

Having moved your clients 'through the stormy periods covered,' when others are spending their time 'getting soaked (once again)' and then trying to cleaning up their soggy and 'relatively deteriorated shoes', has put you and your clients significantly ahead, while others are struggling to catch up. You instead will be able earn your clients 'additional shine,' with the saved time, saved loss, and saved energy, from their better protected and better overall positioned portfolios, as they begin to advance from healthier positions, having been well covered.

And your clients will love you for this too.

And, in the meantime, your clients can continue to enjoy the security and advantage of their still buff shoes. Even as they had through the storm. You, and they, being that much ahead of the average, who, unfortunately, once again, found themselves back in 'deteriorating rain and storm puddles', uncovered. Their 'un-protecting' advisers are now trying to consoled, "Don't worry, eventually the sunshine will dry out your shoes. And we will try to buff them back up once again."

While others are drying out to get back to where they were, your clients are getting ever ahead, and from ever stronger positions!

And your clients will vividly see this significant difference (as they always do) and get to live in it too.

And they will love you for this, also.

And they likely will happily 'spread the word' on what you have done for them, with these critical protections, and further advancements and critical differences too.

And you will love them for that!

Walk in these shoes!

ProtectVEST can show you how. Take the next step... Learn the ProtectVEST Difference

ProtectVEST and AdvanceVEST by EchoVectorVEST MDPP can show you how.

ProtectVEST and AdvanceVEST By EchoVectorVEST

"We're keeping watch for you."

"He that has the eyes to see, let him see..."

PROTECTVEST AND ADVANCEVEST BY ECCHOVECTORVEST MDPP PRECISION PIVOTS

______

Enhancing major market exposed portfolio value security and overall portfolio value performance and return through the application and utilization

of specialized derivatives as 'portfolio value insurancing hedges' when also combined with the power of the Motion Dynamics and Precision Pivots

Forecast Model and Alert Paradigm and the ProtectVEST and AdvanceVEST By EchoVectorVEST Active Advanced Risk Management

Trade Technology and the Precision Pivots Active Advanced Management Position Value Optimization Method.

"We do more than keep watch, we keep watch for you."

It Can Rain and It Can 'Pour,'

And Yes, 'The Sun Will Come Out Again Tomorrow,'

But Why Suffer Those Steep Stock Portfolio Value Declines in the PROCESS,

and Then Have to 'dry out all over from it' Once Again?

YOU WORK SO HARD, AND WILL AGAIN,

JUST TO GET BACK TO WHERE YOU WERE,

WHEN YOU COULD HAVE BEEN ENERGIZING

AND FURTHER ELEVATING YOUR ACTIVE MANAGEMENT PROTECTED PORTFOLIO TO EVER HIGHER LEVELS INSTEAD!

VISIT

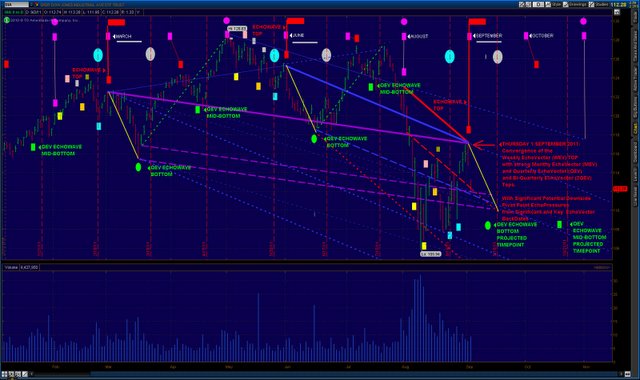

ProtectVEST MDPP Provides Active EchoVector WavePattern Analysis, Charts, and Forecast on Select Financial Instruments and Vehicles.

Included Are Indicative EchoVector EchoBackDates And Key EchoVector Forecast EchoTimePoints to Help You Better Interpret Prior Market Behavior and Consider Within Context Potential Future Market Direction.

Below is a Focus Example of a Prior and Very Useful ProtectVEST by EchoVectorVEST MDPP EASYGUIDECHART For the Major Market Large Cap Dow 30 Industrials Composite Index, DIA ETF Equivalency Basis, With Weekly, Monthly, Quarterly and Bi-Quarterly Timeframes in Perspective from 2010 and 2011. It Examples the Utility and Sophistication of the Forecast Model and Alert Paradgm to A Degree Utilizing Geometric Visual Illustration.

SAMPLE FROM THE ARCHIVE

PROTECTVEST AND ADVANCEVEST MDPP PRECISION PIVOTS

LEARNING ACTIVE ADVANCED TRADING POSITION MANAGEMENT FOR TODAY'S CHALLENGING AND VOLATILE FINANCIAL MARKETS ENVIRONMENT!

ProtectVest and AdvanceVest by EchoVectorVest, Divisions of Motion Dynamics and Precision Pivots,

Bradford Market Research and Analytics

Currently A FREE Educational, Forecast Opinion, and Forecast Methodology and

Related Strategies Discussion Resource and Forum